|

Staying Ahead

of Online Fraudulent Tactics - Prevention against Fraudulent Transactions

via Internet

A statistical survey in 2005 revealed

that damage derived from fraudulent transactions via Internet was estimated

at some USD13,863,003, more than double the damage recorded in 2004

(totaling USD5,787,170) In light of increasing online fraud transactions,

protective measures should be prepared to minimize any risks that may

arise from such fraudulent tactics. In detail:

Check

purchase orders regularly

Spend more time checking

your purchasing orders - minimize opportunities for fraud

Fact: Authorized credit

cards (on which purchases and transactions are approved by issuer banks)

refer to credit cards that contain sufficient credit allowance to make

the purchase in question, though the transaction may prove to be fraudulent.

To avoid this, regular checks of your purchase orders should always

be made before bill settlement.

A recommended method is to check the

"Origin of Order". Cancellation should be made if you are not certain

of the origin of the order. For further information, please view your

Online Merchant Report before clicking on the Menu Transaction List.

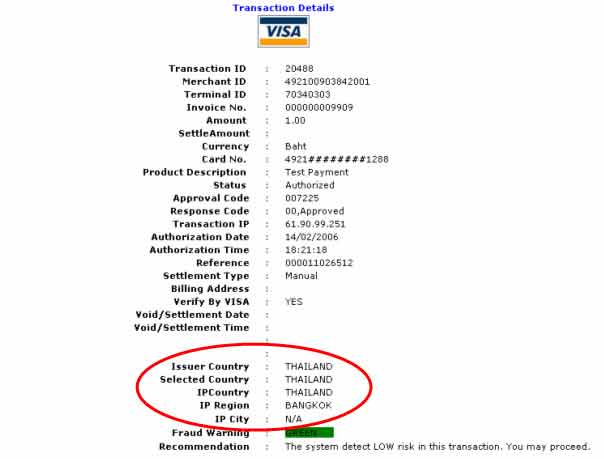

Then, click Details that pertain to each Transaction as shown in the

screen below:

Useful

information:

1.

"Issuer Country" is the country where a credit card issuing bank is

located, which can be checked via K-Payment Gateway system.

2.

"Selected Country" is the country where the credit card issuing bank

is located as used by the credit cardholder.

3.

"IP Country, IP Region and IP City" is the country, region and city

where the purchase order (s) was/were made by customer.

If irregularities are

found, i.e., discrepancies between the Issuer Country and Selected Country,

or between the IP Country and the delivery address, you should recheck

the information with your customer before bill settlement.

Know

your customers

You should create a membership system to be used as a

database and tool to check purchase orders.

If your website does not

have a membership system, the accuracy of purchase orders should be

verified by creating a form for the customer to fill in his/her name

and the place of delivery. Then send it to your customer to have him/her

sign their name the same as the signature appearing on the back of credit

card. Request him/her to return the form together with a photocopy of

their credit card to you via fax as confirmation on his/her purchase

transaction and verification of correctness of the issuer bank and credit

cardholder.

If you cannot use such

a form to confirm the purchase order, you should contact your customer

via phone or e-mail to verify the information. However, you must be

aware that sometimes customers' free e-mail (for example, hotmail or

yahoo) cannot be used to verify clients' information.

Cases

you must take special caution!!

If you encounter the

following purchasing orders, you must exercise special caution.

- Purchase orders whose delivery addresses

are different from payer's address.

- Customers who use free e-mail or

anonymous e-mail addresses.

- Purchase orders from internationally,

or those that require delivery to international addresses.

- Purchase orders that provide abnormally

little information about the buyer.

- Purchase orders that order goods

in abnormally high volume.

- Purchase orders that require expedited

delivery.

- Purchase orders for a broad variety

of goods but uses only one credit card number.

- Purchase orders for a lot of goods

of the same style.

- Purchase orders from the same buyer

but with many credit cards.

- Purchase orders made by card from

the group of risk countries such as Nigeria, Malaysia, Russia, etc.

|